(Psst: The FTC wants me to remind you that this website contains affiliate links. That means if you make a purchase from a link you click on, I might receive a small commission. This does not increase the price you’ll pay for that item nor does it decrease the awesomeness of the item. ~ Daisy)

By the author of What School Should Have Taught You.

We’ve talked a bit of late about using the envelope system to help yourself save money. But you may be asking, “Okay, but just what the heck is the envelope system? How do I even go about setting it up?” To answer those questions, let’s delve into the nitty gritty.

What is the envelope system?

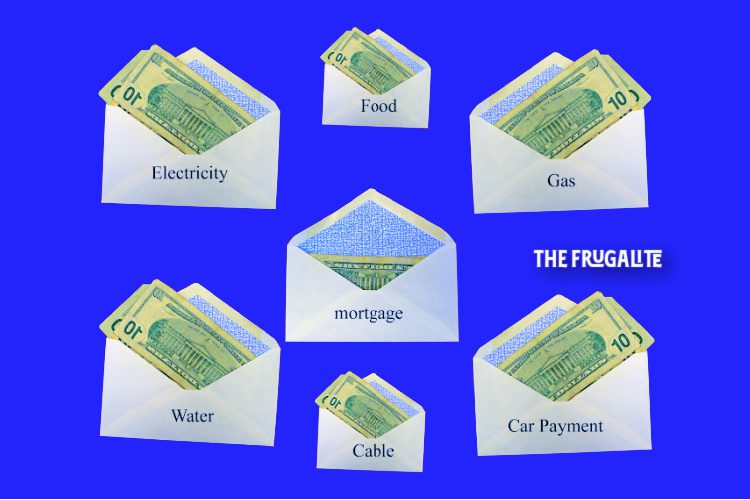

The envelope system is where you look over your monthly expenses, create a budget, and calculate exactly how much cash you need on a monthly basis to pay all of your bills. You then go to the bank, withdraw that cash, and put the necessary cash into a series of envelopes.

Each of these envelopes has a specific designation.

One envelope would be for groceries, one would be for clothes, and one would be for your rent. The money that you have in those envelopes is the money you have for that particular department.

Once all the money is out in the clothes envelope, you no longer have any money for clothes, so you don’t buy any more. The whole point is to get you to stick to a budget.

How do you set up the envelope system?

The first thing you’re going to have to do is to sit down and figure out your monthly expenses. You likely will have your electric bill, water bill, rent, and insurance bill all sitting there right in front of you. You’ll be able to figure out how much you need on a monthly basis for each of those departments without a problem.

If the bill says you owe $700/month in rent, well, that’s what you need.

After the easy step is done, you’re going to have to take a bit of a deeper look.

What I do is occasionally take a three-month look.

What did I spend the past three months on average for each department? So, if you’ve been living off of your debit or credit card, you’ll need to grab three months’ worth of statements and then systematically go through each purchase and assign a category to it.

Every Piggly Wiggly entry you see would be your ‘groceries’ category. Every Exxon would be your ‘gas’ category, and so on. You’ll then be able to come up with a fairly good idea of what you spend on a monthly basis for each category.

Some of the categories that I personally set up are:

- Groceries

- Gas

- Health insurance

- Car insurance

- Animal feed

- Electric

- Fun money

- Car maintenance

- Emergency fund

- Gym membership

- Vacation

You get the idea.

You’ll then be able to know exactly how much money you spend on average per month in each category. Knowing where your money is going is half the battle. If you know where it is going, then you can tell it where to go, making intentional decisions to redirect its flow.

One of the most important parts of the envelope system is the emergency fund.

I learned this from Dave Ramsey and life experience combined. You do need to have an emergency fund envelope. Ramsey recommends that this base-level emergency fund be $1000. You may end up in a situation where you have a major HVAC, plumbing, or engine problem that needs to be fixed.

Not having an emergency fund sets you up for major financial havoc when those events happen (And they will. You can’t ignore the laws of thermodynamics. Entropy grows, and things decay.). This is why you have to make sure that you are regularly budgeting to get your envelope system up to speed.

Other points worth making…

I do think that fun money, clothes, and vacation are all important envelopes to consider as well. My time spent as a personal trainer taught me that you can’t get people to go cold turkey on stuff typically. If a weight loss client is really having trouble with stepping away from the Dr. Pepper, your best bet is to not tell them to go cold turkey and never drink it again, but instead, to get them to limit themselves to only drinking it 3x a week, or something of the like.

Otherwise, let me tell you what happens every single time.

The person deprives themselves of something they really want. And then they binge. And the binge may be even more unhealthy of a decision than they would have made just going along “normally.”

I think it’s the same with money.

If I deprive myself of making any fun purchases whatsoever for a while, eventually, I get to the point that I say, “Shoot, I haven’t bought anything for a long time. A new air compressor is a good idea.” And then I spend $500.

That itch is going to be there whether you like it or not. I think the best action is to go ahead and scratch it a bit. To do this, I try to stick to $20/month of fun money. I can spend this on literally whatever I want, or I can save it for a larger ‘fun’ purchase. I scratch the itch, I discipline myself, and I save money in the process.

The same goes for vacations and clothes.

You have to go on vacation or take a break from work every once in a while. It helps you to avoid burnout and allows you to enjoy life more. Putting a little money aside every month for a yearly vacation is a good idea in my book. Even if you can only put together enough over the course of a year for 1-2 nights away, I still think that’s fantastic and better than nothing.

Regarding clothes, I think that men in particular (at least most of them) think they can get away with never buying clothes after high school has passed ever again. Good luck.

You need to buy clothes. Make a small envelope for that department, even if you’re only putting in $5-10/month there as a dude. You can do pretty well at Goodwill with that much money on clothes.

That’s basically how I set up my envelope system.

It’s saved me a lot of money, and I think it can save you a lot of money as well. When you can visually see how much cash you’ve spent, it helps you to avoid spending more. You can’t do that when there’s just a credit card in your hands.

But what are your thoughts on all this? Have you used the envelope system before? Do you have any suggestions for folks who are just getting started? Let us know what you think in the comments section below.

About Aden

Aden Tate is a regular contributor to TheOrganicPrepper.com and TheFrugalite.com. Aden runs a micro-farm where he raises dairy goats, a pig, honeybees, meat chickens, laying chickens, tomatoes, mushrooms, and greens. Aden has four published books, What School Should Have Taught You, The Faithful Prepper, An Arm and a Leg, The Prepper’s Guide to Post-Disaster Communications, and Zombie Choices. You can find his podcast The Last American on Preppers’ Broadcasting Network.

5 thoughts on “How to Get Started with the Envelope System”

I’d add an envelope for the loose change you may find as you are out and about your business. Granted it is likely to not amount to much at first but you might have a few bucks at the end of a year. I’d attempt to find the owner of a large amount of cash but not a penny or quarter in the grocery store parking lot.

and so if you arent using a checking acct, do you physically take the cash to the utility or what? the whole point of paying bills online (which I hate anyway), is to stop using a checking acct, sending the check thru the mail, etc.

how do you pay the bills with cash?

Cash will not always be available and may soon disappear if the government has it’s way.

I’ve heard of this for years, but it really is too much of a pain in the gluteus maximus.

Here’s what you can do. Use an envelope. On this envelope write what your monthly budget for an item is. Once you make a purchase of that item (e.g., food), write down what you spent and subtract it from your budget. What you have left is what you budget for the rest of the month. Next week (or whenever you have to shop), you do the same thing… until you’re “out of money.”

As for some items, how do you pay a mortgage with cash? My mortgage company won’t take it. Either check or debit. If you have your mortgage company in town, do you drive down there and pay them a wad of bills? How does that work. I see where you could pay some bills (like gas, water, and electric) at the supermarket, but there isn’t always someone at the courtesy booth. That happened to me back in the 80s, more than once.

If you really want to save money, stick to your budget, learn to meal plan, cut out the luxuries, and learn how to perform some of your own maintenance and repairs.

Great system! I’ve been using it for years!

So you don’t pay yourself first? I give myself a monthly salary but after reading this article I’m gonna lower my salary and add other catogories to my system!

Thanks so much.