(Psst: The FTC wants me to remind you that this website contains affiliate links. That means if you make a purchase from a link you click on, I might receive a small commission. This does not increase the price you’ll pay for that item nor does it decrease the awesomeness of the item. ~ Daisy)

By the author of The Ultimate Guide to Frugal Living and What to Eat When You’re Broke

Ask anyone with a tight budget and they’ll tell you: the numbers are lying.

Sure, the government and media are swearing to us that our economy is A-OK, but you and I both know that isn’t true. Personally, I hate this kind of gaslighting because it makes people feel like failures if they’re struggling financially. It makes us all feel utterly alone in our difficulties and that’s simply not the case. Sure, you may have made some mistakes over the years, but it doesn’t mean that your situation is entirely the result of a series of terrible decisions.

Regardless of the cause, we’ve got to play cards with the hand we’re dealt. So, here are some ways you can downsize and save some money. As always, not every method will work for every person. But if it will work for you, you might be able to reallocate a sizable sum each month.

Get rid of your car.

As I’ve mentioned here before, my Jeep gave up the ghost, and I haven’t yet replaced it. As a city dweller, public transit gets me from A to B, and when I can, I enjoy walking in all types of weather. Finally, I work from home so that means I don’t need transportation on a daily basis.

There are a lot of savings involved in getting rid of your wheels:

- No car payment

- No vehicle maintenance expenses

- No car insurance

- No fuel

- No parking fees

There’s a pretty big range there in savings, depending on your situation. I myself save several hundred dollars a month, even using Ubers for doctor’s appointments once a month.

Downsize to a cheaper apartment.

This tip is for renters and has to net several hundred dollars a month to be worthwhile. If it’s only $50 or so it’s just not worth the cost of relocating, paying deposits, and moving your utilities.

But if you can cut back and live in a much smaller and cheaper place, it’s possible to save hundreds each month as a renter. Got a lot of stuff? Some folks who have moved to a small studio apartment and gotten a storage unit still report savings of $500-700.

Remember the added costs of transportation and fuel costs for getting to work and school when you calculate savings for a move. If you spend a whole lot of time and money on a commute it might be a better idea to pay MORE in rent and less for transportation. Do the math to see what works best for you.

Get a roommate.

Are you tied into a lease or own your home? You might be able to save some money each month by making the choice to rent out a room in your home.

I’m currently living in two rooms and a bathroom in someone’s house. I have my own small kitchen and entrance, and the only things we share are a wall and a laundry room. It’s worked out delightfully. I pay a lot less than I would for an upscale apartment in a high rise and my landlady gets help paying her mortgage.

Even if you don’t have a separate mother-in-law suite, you might be able to rent out your guest room and share a kitchen with a quiet adult or student. Make sure to outline the rules clearly from the start to help prevent problems.

Downsize to one streaming service.

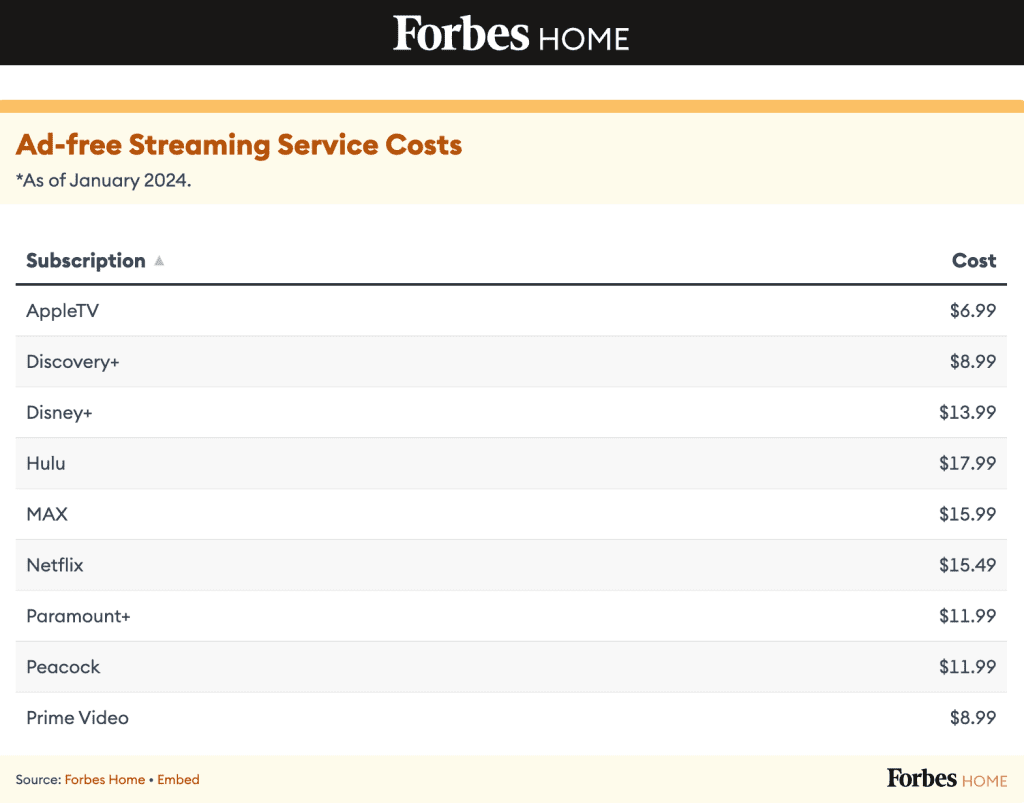

The prices of streaming services have been going nowhere but up lately. On average, most Americans have three streaming service subscriptions. For ad-free streaming, Forbes shares the costs of the most popular services.

If you have multiple services you could be paying almost as much as cable these days.

I personally have Amazon Prime because of free shipping and other benefits, so I always have that service. For the other services, I rotate. If there are several shows on a service that I enjoy, I wait until the full season is available, then subscribe for a month (often taking advantage of a sale.) I carefully note when the payment renews and cancel before that happens. I go back and forth between Hulu, Max, Paramount, and Netflix, keeping only one a month.

This isn’t as much of a savings as some of the other suggestions but you may find it frees up a week’s worth of grocery money if you have multiple services.

Downsize some memberships.

Speaking of subscriptions, there might be more things you can cancel. Think about all the memberships and subscriptions you have and decide if they’re really worthwhile or just a habit that you haven’t canceled.

Apps on your phone: I used to use the Calm app every day but now use it rarely and can find a lot of the same things on YouTube. GONE. You may have other paid apps like diet and fitness ones, meal planning, motivational quotes, etc. If you don’t use them regularly or could replace them for free, you could save up to 20 a month per app.

Products you get delivered: Do you have any products you have delivered regularly? Are they ones you really use? Do you have a bunch of extra ones stacked up in your closet? And have you recently done some comparison shopping to make sure you’re getting the best deal?

Meal services: Okay, if you’re on this website you probably don’t subscribe to meal services. But, if you do this is the second most expensive way to buy food. If you do this instead of ordering from Doordash or Uber eats, then it might be worthwhile, but otherwise, it’s probably time to just do some weekly food prep for yourself.

Fitness memberships: Be honest. Do you really use your gym or fitness membership or do you just PLAN to use it? If you’re not using it enough to get your money’s worth, it’s got to go.

Memberships that reduce the price of other things: Instacart and Doordash have memberships you can buy each month that reduce the price of each delivery you receive by knocking out some of the fees. But – it’s still more expensive to order Doordash than to go to a restaurant which is more expensive than eating at home.

One reason some people are hesitant to get rid of certain memberships is that they “got a great deal.” Hey, I’ve done it too, but if you aren’t using it or can live a perfectly wonderful life without it, you’re still blowing money unnecessarily.

Subscriptions I kept:

- A few subscribe-and-save necessities on Amazon (otc medications and household goods)

- DuoLingo – practicing languages daily is great for my brain and it’s a product I truly use. I renew every year on their Black Friday sale.

- Lumosity – the brain games have really helped me deal with my scattered thoughts. I use this daily as well. This is also purchased at the lowest price of the year.

- Instacart: Because of a mobility issue, I have an Instacart membership to have heavier groceries brought to my door for a lower price. It’s still more expensive than going to get things myself, but going to get things myself isn’t really feasible in my current situation.

How do you downsize?

Will any of these ideas work for you? Are there any changes you made that save you a significant amount of money? Do you do a downsize audit every year to make sure you are spending money wisely? What are some other ways folks can downsize?

Let’s discuss downsizing in the comments section.

About Daisy

Daisy Luther is a coffee-swigging, adventure-seeking, globe-trotting blogger. She is the founder and publisher of three websites. 1) The Organic Prepper, which is about current events, preparedness, self-reliance, and the pursuit of liberty; 2) The Frugalite, a website with thrifty tips and solutions to help people get a handle on their personal finances without feeling deprived; and 3) PreppersDailyNews.com, an aggregate site where you can find links to all the most important news for those who wish to be prepared. Her work is widely republished across alternative media and she has appeared in many interviews.

Daisy is the best-selling author of 5 traditionally published books, 12 self-published books, and runs a small digital publishing company with PDF guides, printables, and courses at SelfRelianceand Survival.com You can find her on Facebook, Pinterest, Gab, MeWe, Parler, Instagram, and Twitter.

3 thoughts on “5 Ways to Downsize and Save Money”

Some people (instead of downsizing into a rental property) downsize into the gypsy life by moving into a vehicle … whether theirs or an acquisition. That way of living is covered in great detail via several different channels on YouTube … of which CheapRVliving is just one of those. Whether boondocking (living out in the sticks somewhere) or stealth camping (living in various parking lots, on streets, public places not far from a local gym membership for taking showers, etc) there’s a choice between storing one’s stuff where there’s a rental bill from a public storage facility and/or deciding what to sell off and/or donate.

A local library card can be a dirt cheap replacement for LOTS of subscriptions and free or nearly free interlibrary loans to get a look at books your local library doesn’t have. That works for most titles once they have passed the 6 months since publishing date. There are a few exceptions such as very rare, high value antique, or expensive reference titles. The US interlibrary loan system has been around since before 1900.

It’s also worth exploring the several ways that privacy.com can help you limit what (and how long) sellers can charge against your charge cards … and protect your cards from scammers by creating substitute card numbers for specific vendors while denying scammers the ability to loot you.

–Lewis

Having lost my DH a year and a half ago, I had a lot of decisions to make. Decided to move closer to the kids and grands lile we always talked about. I was able to transfer to another store in the same chain ( no loss of pay, vacay, seniority). But finding a place to rent in this area is next to impossible. So the kids and I agreed it made more sense to purchase a camper and put it on their property. This way, I can help them pay bills rather than line a landlords pockets! Talk about a downsize–my camper is 28 ft. Cozy, but enough for just me. Plenty in storage (3 BR just under 1K SF). It will be gone thru once the weather gets better. Some items I will try to sell outright, some will be donated, and I will also have a dreaded yard sale. Of course, the things I just can’t bear to part with will stay in storage but I should be able to get a much smaller unit too.

We live 4 miles from the nearest small town, so no vehicle isn’t a viable option for us. However, after the most recent repairs didn’t keep our car running, we’re down to just our pickup. That pinches for a family of 5 drivers, but so far we’re making it work. The plan for the future is to fix the car, but right now, not having to pay the $1800 for 6 months of liability is great.

The only streaming we have is amazon, which our son shares with us, but we rarely watch it and I’d never pay for it myself. We can watch nearly anything we want online and still have our DVD collection. In fact, I’m toying with the idea of canceling the internet. It would be harder to read the news, etc. just on our phones, but maybe that would be a good thing because I’d probably spend a lot less time online.

Family land: no multiple rent/mortgage payments. Yes, sometimes we get on each other’s nerves but we also have each other’s backs.