(Psst: The FTC wants me to remind you that this website contains affiliate links. That means if you make a purchase from a link you click on, I might receive a small commission. This does not increase the price you’ll pay for that item nor does it decrease the awesomeness of the item. ~ Daisy)

In this article, I want to open up about something near and dear to my heart, something that I struggle with right alongside many others. Mental health.

Over the years, I have struggled a lot with depression and anxiety, and I’ll be the first to admit it. I didn’t always feel this way. In my journey of self-discovery and getting better, I’ve found that opening up and being honest with those around me has helped. I won’t get into the nitty and gritty of some of the causes and events in my life that have led to my down periods, (that’s not the point of this article). Suffice it to say that mental health has played a large role in my life since my early teen years, and I have gone through a lot.

While there are many articles out there on mental health in general, it’s often overlooked how much your mental health can affect your finances.

You’re not alone.

First off, I want you to know that you are not alone. What many don’t realize is that an estimated 26% of American adults struggle with mental health issues in a given year. That’s approximately 1 in 4 people, hundreds of thousands of people. It’s not easy, and it is often difficult to find support. However, knowing that you are not alone, well, for me that was huge.

Just a note, if you are really struggling and you need to talk to someone, National Suicide Prevention Lifeline is a free service that is always there to help. They can be reached at; 1-800-273-8255.

What does money have to do with mental health?

Money issues can come in all shapes and sizes. It can stem from an unexpected hospital bill, a job or income loss, debt (like credit cards) piling up, unexpected expenses like your fridge dying or a car breaking down. The possibilities are endless, but they all result in one thing; more financial stress. With many Americans living paycheck to paycheck. Just one unexpected expense can send you into a financial freefall.

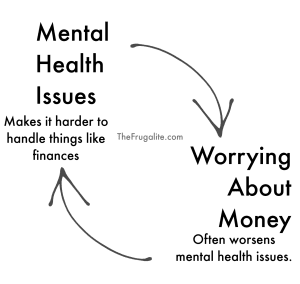

When money issues come out to play, this adds undesired stress and strain on nearly every aspect of your life, and the fact that we’re going through a pandemic right now doesn’t help. Money and mental health, when you let it, can become a vicious cycle.

When you’re struggling with your finances, it can often worsen any pre-existing mental health issues. As your mental health deteriorates, it makes it even harder to handle all the things your life throws at you. This vicious cycle will often feed into itself until you do something to break it.

Need an example?

Let’s set the scene.

You live a happy little life with your two children, ages 3 and 7, and your husband. Your husband works the morning shift at a factory, and you work evenings at a little diner across town. You don’t see each other very often, but you’re happy, and by working different shifts, you’re able to save on daycare expenses as someone is always home with the kids.

You think you’re managing fine. Your not rich by any standard, but, over the last couple of years, you’re proud of yourselves for managing to save about $500 in an emergency fund. While you know it’s not much, it at least provides a little cushion, if, say, your one and only car breaks down.

One day, there is an outbreak of Covid-19 at your husband’s factory, and he catches it. Bad. Suddenly, he’s in the hospital on a ventilator, your kids manage to avoid it (by some miracle), and you only get a minor case. While you didn’t get it too badly, you still are off work for a month, your husband is in the hospital for 3 weeks, and your kids can’t go to school.

Thankfully, you had that emergency fund, and that managed to pay for your groceries, and a little bit of the rent, but all of the sudden, you’re behind on rent, you have a giant hospital bill to pay, and you just returned to work after a forced three week “vacation.” While you’re starting to bring in a bit more money again, you start to worry, and really frett, because the bills that you were barely managing to pay before are piling up, and you’re down to half your household income.

You begin to run yourself ragged at work, picking up every shift you can to try and make ends meet, but this just adds to the stress. You get a second job and are now working 14 hour days 6 days a week, while also trying to take care of the kids, keep the house clean, and make the meals, as your husband is still recovering.

Barely getting any sleep, and constantly needing to do something, you start to become depressed and your energy starts to dwindle. You start to slip up and lose hours at work. This makes the money tighter.

Then, your car breaks down. The repair will cost $700, and you need it fixed because your main job is all the way across town, and there isn’t public transit due to Covid.

You don’t know how you’re going to pay for the car, rent, and groceries this month. You become so depressed and anxious, you have a full-on breakdown.

I’ll stop there. I think you get the idea. The point though is that this, or sometimes even a worse scenario than this, is the everyday reality for many people. As the money issues get worse, it gets harder to pay your bills, so you try to work more, and it gets harder to handle your stress. The cycle is vicious, and not somewhere anyone wants to be.

Your mental health can also cause spending sprees.

When I was going through one of my hardest times, I didn’t have work for 8 months, and I still had to pay my bills, and get my essentials like groceries. So my credit cards got racked up.

As the amount owing got higher, it made my depression worse, so I tried to buy things to make me feel better (not something I recommend). It got even harder for me to stick to my budget which I eventually just threw out the window.

4 years later, I’m still struggling to get out from under the mountain I created, but slowly and surely, I am.

Emotional spending is extremely common.

Emotional spending occurs when you buy something you don’t need and, in some cases, don’t even really want, as a result of feeling stressed out, bored, under-appreciated, incompetent, unhappy or any number of other emotions. In fact, we even spend emotionally when we’re happy. For instance, what did you buy yourself the last time you got a raise?

There’s nothing wrong with buying yourself nice things from time to time, as long as you can afford them and your finances are in order, but if you’re spending more than you’d like to on non-necessities or are struggling to find the cash to pay the bills or pay down your credit card debt, learning to recognize and curb your emotional spending can be an important tool. (source)

It’s difficult, but you can get a handle on it.

Recognize the Signs

There are so many signs and symptoms of stress and depression, and it’s important to recognize them in yourself before they get too bad. When you do, you can better adapt and reassess, so hopefully, things don’t get as bad.

Emotional Symptoms

- Getting more agitated or frustrated

- Getting overwhelmed, and feeling a loss of control.

- The inability to relax

- A lowering self-esteem

- Avoiding others

Physical Symptoms

- Low Energy

- Headaches

- Aches and pains

- Upset stomach (in all it’s various forms)

- Insomnia

- Change of appetite

These are just some of the most common symptoms that people experience, but there are still so many more.

How can you manage stress before it breaks your budget?

There are many things you can do to help with your stress and depression when the symptoms start to creep up, but the biggest? Find a way to do some self-care.

Self-care is a huge thing, and not just when things get hard. I try to practice at least a little self-care every day that way it increases my tolerance to deal with the hard stuff.

Below are some of the things I do that cost very little and help not only me but others as well.

Get some fresh air

Getting outside (especially out for a walk), really can improve your mental health. Not only will you get a little more Vitamin D, but you’ll also get a little exercise (which will give you endorphins and endorphins make you happy), having something different to focus on.

Write it down

Try getting something to write on. Doesn’t matter if it’s a notebook, a journal, a scrap of paper, or even the notes section on your cell phone, just get somewhere to write.

Now, take 2-5 minutes, and just dump. Write down all the negative things going through your mind. All the self-doubt, or anxiety, the stressors, the annoyances, just anything negative in your head, I want you to write it down. You can put it in point form, sentences, whatever you want. This is for you and you alone.

Once you’ve done a negativity dump, comes the hard part for most.

I want you to take a minimum of 2 minutes (trust me, for most this, is harder than it seems at first), and I want you to write down the positives. This can be anything, it can be things you’re grateful for or things you like about yourself or your good at (I highly recommend at least a couple of these), things that make you happy, things you cherish and are passionate about. Again, this can be in any format you want. Just make it positive.

By doing this, you get a chance to just dump all of your negative feelings and thoughts and replace them with all things good. I recommend doing this at least a few times a week (for me it’s a daily habit). Do it first thing in the morning to set a positive mood for the rest of the day, or right before bed, so those anxious pesky thoughts don’t keep you up.

Do something you enjoy (guilt-free)

It’s okay to take time for yourself. This is something many struggle with, especially those in the role of taking care of dependents. Think of it this way though. If you’re on an airplane, and the oxygen masks come down, you’re supposed to put on yours before helping anyone else. Why? Because, if that person beside you, be it someone incapacitated, a child or anyone else struggling can’t put on their own mask, they’re sure as heck not going to be able to help you put on yours if you pass out from lack of oxygen.

You have to help yourself first in order to be able to help others. If you leave nothing for yourself, you won’t have anything to give to others. And you know what? It’s okay to take care of yourself. I know it’s hard sometimes, but you matter to, so take that time for yourself and don’t feel guilty about it.

Some things I like to do;

- Read a chapter or two of a book

- Take a nice, long, hot bath (or shower if baths aren’t your thing)

- Watch an episode of your favorite show

- Take that walk, do that exercise

- Do your hobby, whether it’s painting, baking, woodworking, knitting, do something that makes you happy. (Or try learning one of these hobbies that could potential give you a little financial relief! )

Watch or listen to something motivational

Whatever your circumstances, there is always hope and motivation to be found. A mentor of mine recommended to me I start off every day with something motivational. It’s really helped me, so I’m passing on the advice to you.

Try starting off each morning with something motivational. There are a million videos on youtube or podcasts on the internet. If you find yourself short on time, that’s fine. You don’t have to sit and do only that. Play the video while you get ready for the day. Listen to the podcast on your walk or commute to work.

Remember, you’re not alone

I know I said this at the beginning, but I just want to remind you once again that you are not alone. If you need help, reach for it. The people that love you would rather listen to your problems than your eulogy.

There are many recourses for mental health issues and financial issues. There is always another option.

And again, if you are really struggling and you need to talk to someone, National Suicide Prevention Lifeline is a free service that is always there to help. They can be reached at; 1-800-273-8255.

What are your thoughts?

Have you ever had money problems due to mental health issues? Or have you ever had mental health issues due to money problems? What is your advice? Share your story in the comments.

3 thoughts on “Money and Mental Health: A Vicious Cycle”

The past few years have been nearly overwhelming with physical demands and bills with no good answers. I read, work outside, spend a little extra time with my sweet rabbits and chickens, even knit a few more rows on a pretty sweater I’m making for myself.

My husband’s mind was noticably failing and he started getting lost. My second son was injured with brain bleeding that nearly took his life and left him unable to care for himself for quite awhile. To be released from the hospital they required i move him in with us. That was so expensive feeding another adult, 3 to 6 appointments per week in a city 45 minutes away that we soon fell behind on the mortgage. I was past 65 and needing to take care of my husband and son so I couldn’t unretire to pay bills. We lost a lovely home rural home. Not fancy but a comfortable home in a place we loved.

I negotiated a “deed in lieu” of forclosure. It saved the finance company money and gave us a few months to get moved. I owned land 100 miles away in a place I never planned to move back to. Still it beat being on the street with my son and husband unable to fully care for themselves.

I worked hard repairing a mobilehome and my son was doing better and began fixing up a little home I’d built for my parents many years before.

We’re still living on the old place and several years later still working on it a little at a time. I grow a garden. I was able to move my rabbits and chickens and at 74 I’m building a new coop. Home is still piled up and a work in progress. The bedroom is unheated so we sleep under a pile of warm covers and just have a fire in the living room pellet stove while we’re up. Except for last year I’ve grown a garden and canned the excess. Last spring I caught Covid. No pneumonia, thank God, but I probably should have been in the hospital. I lost nearly 50 lbs while too sick to eat and reduced ability to eat after I recovered… actually recover is a misnomer. I’m still slowly recovering. It was weeks before I could walk through a store to do our shopping. A neighbor took cash and a list and did the shopping while I was sick and for weeks afterwards. He also took us to Dr appointments. I could barely get around in the home so he also fed and watered my critters.

This fall my neighbors both caught covid. She spent a few a days in the hospital. He was there three weeks and died. They were raising three little grandchildren. She’s now going on with the help of a son. I try to help where I can and encourage her.

My husband is now past 80 and physically failing. I stay busy. Work hard, and find little joys to focus on. I’ll appreciate his income while there are two sets of social security checks available. The bills are caught up except I’m a few months behind where I want to be on property taxes. I’ll plant a big garden again this spring. I’ll dig it with a shovel. Good exercise in the fresh air. I love tending growing plants. Harvesting is a joy I look forward to.

I’ve been able to put a small life insurance policy on us both so final expenses will be covered.

Before I got sick last Spring I’d bought 12, 10′ sections of 4″ thin wall PVC and a dozen elbos to try hydroponics. I think I’ll be up to working on that this Spring. It will be an interesting experiment. I’ve slowly been buying solar equipment and I’ll try my hand at building a ground mount array. No, I’m not climbing on the roof. I did buy a book and I’ve been reading articles. I used to help my Dad and late husband with building projects and wiring so I’m intrigued rather than intimidated. I’m building a little room to house batteries, charge controllers and inverters. I’m planning several smaller systems rather than on a big connected array. Easier for me to handle and if there are repairs I won’t be totally without power again. Each will have it’s own fuses and cut off switches. Being without power the past 14 months has been survivable but unhandy. We live frugally so I’ve been paying cash as we go. It’s given me time to learn, gather, and set priorities.

Depression hasn’t been an issue but I’ve tried to do little things for me. I know that’s important. It keeps a trickle of joy always coming in. To be able to keep giving I know I can’t run on empty. If I start to feel sad or lonely I get a quick boost from petting or holding the rabbits. Right now I’m daily watching as one of the does will soon be a Mom.

I read my Bible each morning then spend some time in prayer while my husband is still sleeping. Then I start a fire, get something started for breakfast. It will cook on the heat collector for the rocket stove. Then I get my husband up and dressed. He loves oatmeal with butter and brown sugar. Yesterday was breakfast burritos. I set

my camp coffee pot next to the heat. It’s soon ready. When he’s dressed we’re ready to eat.

We still don’t have a table so we eat on individual folding tables near the living room heater. I bought each of us a comfortable recliner. His leather recliner was $40 last year.. my upholstered recliner was $30 this past summer.

I’ve run an extension cord in for a lamp and tv. That keeps my husband entertained when I’m busy. There is power now to a shop building and the well. (Running water is nice.) I’ve set up an antique folding cot as a daybed in the living room. It’s piled deep in pretty pillows. Eventually that will be my husbands spot during the day. While he can still walk he uses his recliner. He needs to be near the heat while the weather is cold.

Life is sometimes challenging, always interesting, and holds enough joy to be worthwhile.

Mental health hasn’t been an issue only because I’ve made it a priority. The past nine years’ finances have been an issue and will remain an issue. I shop with a list. I remade or mended my clothing until the drastic weight loss. I bought used but good clothing and watched clearance sales. I had to replace everything except socks, workboots and shoes. Loosing the weight made movement easier and less strain on my knees. That was a bonus.

I still eat leftovers quickly or can them. That won’t change. It’s become part of my daily planning. Soups, smothered burritos etc use up left overs in new ways. Small batches of cornbread become tomorrows cold cereal or a meals worth of dressing with some chicken and a vegetable. The chicken and vegetable becomes soup or pot pie or gets canned for a future meal. Leftover mashed potatoes top a pot pie or becomes potato pancakes or used in a few yeast rolls. Breads are smothered in gravy for breakfast, soaked in milk and eggs for French toast or with a sliced apple or leftover canned fruit it becomes bread pudding. Crumbs where breads are sliced are stored dry in a jar for a sprinkle over a casserrole or added to bread dressing or bread pudding. And dry bread can become bread crumbs or seasoned croutons for soups, salads or bread dressing. A good variety of herbs and seasonings make scratch cooking good eating. I grow many of the herbs I use. I keep a small window screen handy for drying excess garlic, onions or green herbs. I keep some herbs growing year around in a kitchen window. Cooking liquid or from canned vegetables becomes my soup base or gravy base. Liquid from canned fruit becomes the liquid in bread pudding or added to water makes a pleasant juice drink. I love figuring out new ways to save money on groceries. I’ve made it a game that is it’s own reward.

I did invest in some smaller used baking dishes. I brought in my camp oven that sits on a heat source. I bought 2, 16 oz enameled cups for heating soups on the heater. I have 3 old enameled plates. Food can get warm on the plates or be kept warm on them. I rarely use my propane cook stove all winter. I tent the plates with foil so it can be reused without getting dirty. I save 6 months of propane use. Between meals a 3 gallon pot of water sits on the heater and a tea kettle and coffee pot sit on the bricks beside the heater to stay hot.

Thank you so much for sharing your story. It sounds like you’ve had to go through a lot, but it appears you’re starting to come out the other end still strong and fighting. It’s not always easy, but it’s so important to find those little joys, like your rabbits, and just keep pushing through.

Wishing you all the best,

Chloe

Thank you for sharing your story! It was interesting to read. God bless you!