(Psst: The FTC wants me to remind you that this website contains affiliate links. That means if you make a purchase from a link you click on, I might receive a small commission. This does not increase the price you’ll pay for that item nor does it decrease the awesomeness of the item. ~ Daisy)

While many people advocate living within your means, I don’t think that’s enough. I’m a proponent of living beneath your means. Within is great – it signifies a lack of debt and only spending what you can afford. But beneath is even better, because it signifies that you have quite a bit left over for dealing with a rainy day.

Living beneath your means may not sound like a whole lot of fun. It sounds as though a person doing this is stuffing coffee cans full of dollar bills into spaces in the walls, darning socks until they simply can’t withstand another repair, and eating cold beans in a darkened room.

In reality, it isn’t like that at all.

Learning to live beneath your means can bring you a kind of peace that you never felt before. It can help you survive financial crunches both large and small. It can teach you to take joy in simpler things instead of always looking for the next thing that will give you a surge of happiness.

Some folks are already great at this. It may be elementary to you. Hang in there because there are graduate-level frugality ideas on the way. We’re starting off with the fundamentals and will move on toward high-level, Ph.D. thrift from there.

Others have gotten themselves into a pickle and want to figure out a way to get out of it. Some have cut down to the bare bones and are still having trouble. (If you are not making enough money to pay your bills, this article may help.)

But how do you go from a lifestyle in which every dime goes out to one in which there’s money left over each month? Here are some tips to help you make the transition to a more peaceful financial lifestyle. Many of these tips will work even if you’ve already begun having financial problems, but a few are preventative measures that are geared toward making a lifestyle change when you aren’t yet under the gun.

1.) Assess your budget.

The first thing you have to do is get a clear picture of what money goes out each month. If you use a debit card for everything, this is incredibly easy. If you use cash or a combination, you’ll need to spend at least a month taking notes of where your money is going.

Print out your records for the past 2-3 months. Then, plug the numbers into a spreadsheet. This article has 10 different styles of budget spreadsheets that are free. Pick the one that looks like it will work best for you. (Not the debt reduction one, though – save that for later.)

Once this is done, you’ll have a clear picture of where your money is going. This can be a painful step, but it’s essential. (This article is a good one if your frugal living budget may have gone awry.)

2.) Calculate your fixed expenses.

Your fixed expenses are the baseline of your budget. These are the expenditures that don’t (for most people) change from month to month. They are bills like car payments, rent/mortgage, insurance, gym memberships, cell phone bills, cable/internet …you get the idea. You may not have all of these bills – it not, that’s great. If so, you may want to make some adjustments.

You need to know this magic number to set your budget. This number may not be final, as we’ll discuss below, but it is important to know, if you lost your job right this minute, how much your output would be.

3.) What are your bad habits?

After you plug in your numbers and you can see them there in black and white, it’s time for a grim dose of reality. What you’re taking a look at first are those little random expenditures that siphon away money subtly. The $5 here and $10 there.

You may discover that you spend $300-400 each month for a daily lunch out that didn’t seem like much in individual increments, but when you add the daily $5 drive-thru coffees and an afternoon bottle of water, ends up exceeding $500 a month. Half a thousand. Lotsa money.

Maybe you smoke or drink alcohol outside the home on a regular basis. Do what you’re going to do – I’m not here to tell you to stop smoking or drinking – but look at how much you’re spending to do it. Maybe you buy a giant soda pop out every day for a couple of dollars. That adds up, too.

Nearly everyone discovers that they have at least one bad spending habit in this part. Don’t beat yourself up. Just fix it. Imagine what your life would be like with the money you blow on cigarettes, drive-thru coffee, giant fountain sodas, and happy hour tucked away waiting to help you through an emergency.

Unless you give up some of your bad spending habits and replace them with something more fiscally responsible, it’s going to be tough to live beneath your means.

4.) Start slashing.

Now…it’s time to start slashing those expenditures like Jack the Ripper on a foggy London night.

Getting rid of those bad habits is probably one of the easiest ways to cut spending. Find a substitute that costs less. This can be a process. Not everything has to be cold turkey, especially if you aren’t in a bind. If times are tight, though, you may want to be more relentless and immediate in your cost-cutting.

- Drive-thru coffee: Get a thermos and doctor up your coffee at home, just how you like it, with the perfect amount of cream and sugar. A good thermos can be purchased for about the cost of a week of drive-thru coffees. Like flavored coffees? Check out this list of 25 flavored creamers you can easily make at home.

- Lunches out: If lunch out with your officemates is something you do every day and you’re completely unwilling to give it up, you can work on cutting the costs. Take a morning and afternoon snack to the office and then get something small at lunch, instead of a full meal. Drink water instead of buying a soda pop or a tea. Split a meal with a like-minded colleague. Sometimes it causes fewer questions to just say you’re cutting back (you know you mean money but they think you mean calories). Generally speaking, the portions at restaurants are a bit more than we need anyway, so try just going with a side salad or an appetizer.

- Bring your lunch: It’s even better if you brown bag it instead of going out for a more frugal lunch. When I worked outside the home, I packaged up leftovers every night into a container I could take to work the following day. Then, all I had to do was grab and go in the morning. Bonus – what you bring from home is probably going to be far healthier than what you’d get at a restaurant. If you like to read, bring a book to eat and use your lunch break as some much-needed quiet time.

- Smoking: If you’re a smoker, you already know it’s a terrible habit. I’m not here to tell you that you must stop immediately. That’s your business. But…look at how much money you’re spending! At the very least, consider cutting back. If you are a pack a day smoker, cut down first to 6 packs per week. Put the money for that extra pack into a jar because the visual can be very inspiring. The more you reduce the amount you smoke, the more money you’ll save. And maybe, one of these days, it will be enough to inspire you to quit altogether.

- Drinking: If you drink alcohol, you probably know that going out and indulging at a bar is about a million times more expensive than doing so at home. Consider limiting this to special occasions or once a week, if you go out often.

- Water: Do you buy a bottle of water every time you walk into the gas station or into a store? Do you hit the vending machine at work to buy one? If so, you know that you could buy an entire case of bottled water for the cost of 2-3 individual ones. Stash cases of water in your car and in your office to quench your thirst. Pick up a small water cooler for your office if you like cold beverages. After the initial investment, it will cost you pennies compared to what you spent before. (And from a prepper point of view, you can’t go wrong with having extra water stashed.)

These are just a few ideas. Your bad spending habits could be totally different. Use these as inspiration for cutting your own bad habit spending.

5.) Can you cut any of your fixed expenses?

This is where you can really make a huge difference in your budget. Can any of your fixed expenses be reduced?

- Maybe your mortgage or car payment can be refinanced at a lower interest rate to get you a better payment.

- Maybe you need to move to a less expensive home or area.

- Maybe you need to get a car that you can pay cash for.

- Perhaps your insurance costs could be lower with a different company.

- Do you actually need cable? Maybe you could switch to Netflix for the annual cost of one month of cable.

This article has more in-depth ideas for reducing your fixed expenses.

6.) Get rid of debt.

One of the best ways to live within your means is to purchase things when you have the money to do so, not when you have a handy payment plan. Many of us already have a heavy debt load. If you have to borrow money to get something, you cannot afford that thing. My dad told me that you should always pay cash for everything, but if you can’t, the only things you should ever borrow money for are cars and homes, and then pay them off as fast as you can.

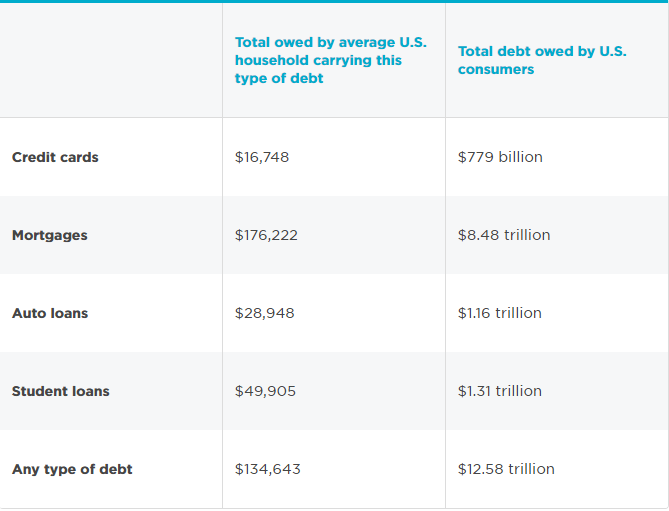

Nerd Wallet reported that in 2016, the average American family owed $16,748 in credit card debt. The scariest part of that is that most credit cards carry whopping interest rates of more than 20%.

Here’s the rundown on other debt via Nerd Wallet. Ouch.

Get rid of that debt. NOW. With all of the cuts you made above, you need to start paying off your debt.

The best way to do this is with the snowball method, made famous by Dave Ramsey in his best-selling book The Total Money Makeover. I’ve used this method myself and it works like crazy. Here’s a quick summary of how to use the snowball method to pay off your debt quickly.

Once you do these things, you’ll be much closer to living beneath your means.

When you can reduce your expenses enough that you have money at the end of the month, instead of month at the end of the money, you are living beneath your means.

After performing these steps, you may have discovered a little bit of money that you could free up, or you may have discovered a lot. That extra money could be enough to change your life and help you weather the storm on the horizon.

This week, take a look at the steps listed above. Apply them right away and see how much you can save. That will get you ready for the next leap toward financial comfort.

This is just the beginning.

This is only the beginning of going full-Frugalite.

If you have questions about getting into the Frugalite groove, post them in the comments section below. I’ll try to address them in upcoming articles. I want to write about the things that YOU want to read and I want to help you with the issues that concern you most. Don’t be shy – let me know.

17 thoughts on “The Frugalite’s Ultimate Guide to Living BENEATH Your Means”

We don’t have a TV or cable so don’t pay for cable service. So much is available on Youtube, often almost immediately after broadcast.

Great example is the Olympics, where you can choose which sport you want to view without the incessant ads or the breathless build-up to final competitions, or the way-too-personal interviews.

Some people look down on the frugal lifestyle, but it is really wise. The peace that comes from being debt-free is real. To get there, I rounded up my mortgage payment to the next even hundred; the extra was added to the principal. Soon the mortgage principal was reduced so much that with a bit more $$ added every month, I was paying off $1,000 of the principal. That math became fun! It was a happy day when I made the last payment. No mortgage payment was essentially a raise in income.

Covid taught us that outside entertainment (Disneyland, movies, sport events, or even dining out) is not essential. I realized that my home-cooked meals are tastier than what restaurants offer, and I know all of the ingredients used. I’d rather purchase quality meats and support my local farmers at the Farmer’s Market; the cost is still less than dining out.

Susan – what a great plan – to up your mortgage payment! We essentially did the same and were thrilled to be paying on the principal as well as the interest. Home cooked meals are almost always better than what you are served in a restaurant and to your precise seasoning likes as well. Farmer’s Markets offer so much and what you or I couldn’t grow enough of in our gardens, the farmer very possibly could. What a great opportunity to support local like minded people!!

Lastly, this is a very good article and should be required reading. Unfortunately, it’s not a popular subject to live within or below your means, but it’s the wisest decision you’ll ever make financially.

I grow grapes. In the fall I can the grapes as grape juice. This eliminates the need for sodas. Where I live eating out is not really an option. The nearest place to eat is 25 miles away. I buy bulk. Every other year I buy a whole cow from my butcher. It comes out to $3.19 a pound this year. I also don’t own a tv. Eggs are not cheap since I am raising and feeding my own chickens, but they are fresh and I know what the chickens are fed. Our house is being built with cash as we go. Therefore I don’t have a house payment. We will have our property paid off in ten years rather than the 30 years that the loan originated. In other words it will be paid off in the next five months. I have no credit cards or car payments. When I do buy a car it is always used. As my husband away says, we can afford anything we want as long as we budget for it.

I salute you…..God Bless

We have always lived beneath our means. My husband and I grew up poor and had to earn our own money from a young age. I also had a very frugal grandmother that lived through WW1, Spanish flu, Depression and WW2. She knew rationing and deprivation and was a frugal master! My motto came to be that I was not going to pay more for the things I had to buy/pay for, so that I could have money for the things I wanted to buy. But you have to work—-you have to buy groceries and cook, clean your own house, cut your own grass, wash your car–not pay somebody else to do it. Clothe kids in yard sale and thrift store things for play clothes, take your lunch to work, turn out the lights, don’t hold the door open to make the air conditioner run—-all the things you may have heard along the way–you have to do them. We were able to and now have no debt and a nice retirement. Our kids are thrifty and are well. When covid hit, they all had savings accounts and only one had to stay home from work for awhile. Many people never learn how to be frugal but feel they “deserve” something so they will never learn.

The key to leaving below your means is budgeting. You did a nice job explaining the budget process. Also, as you mentioned scaling back is good, not having lunch out every day but maybe once a week. Going out occasionally versus all the time makes me enjoy those occassional splurges more.

Our society is so much about instant gratification. Frugality is more about planning and delayed gratification. Rather than going and buying a car with a car loan, I plan and budget to save a certain amount and that’s all I will spend. Although I could afford it, I have never bought a new car.

I shop around for many items. I don’t buy the latest greatest thing with all the gizmos. I ask myself will I even use this gizmos and do I need all those gizmos. My grandmother taught me to buy quality because in the long run it will last longer. Example, I bought quality pots and pans that I have had for decades. I also have found some great deals at Thrift Shops and yard sales.

You can really live well and enjoy life on a budget.

In 1993 I went to a financial seminar that the theme was Get out of debt, Get out of debt. My wife and I decided we wanted to be debt free in 5 years. It took us 3 and this included our mortgage. FREEDOM! We are in a comfortable financial position and can buy most anything we want CASH. You can do it too just spend less than you take in and cut corners.

I have lived in a van since 1985. My sole current income is $1014 in Social Security. I manage to save 10 to 20 percent of that by refusing to let myself buy things I really do not need. This life style aids and abets Rayo’s van vonu by casting such a small shadow that most bureaucrats cannot find a workaround.

So far this article and the comments have dealt with “civilized” and legal bills. Let me discuss some really disgusting, dishonest and/or incompetent bills that you may have to fight against with all the resources you can discover.

In all the years I suffered under AT&T’s phone and internet service, there was seldom more than a couple of years going by without some case of their dishonesty, attempts to bill for repair services not needed, lies about other companies being at fault for AT&T’s incompetence, lying about their warranty on failed equipment, and finally their refusal to stop billing even after my switch to a competing ISP supplier had cut the AT&T cable, replaced it with the new company’s, and after I had turned in AT&T’s router/modem/residential gateway to a local UPS store with full disclosure (following the new company’s explicit instructions). This was the same company which during the federal trial with MCI to break up AT&T, the MCI attorneys discovered an internal memo in AT&T archives that said that MCI must be destroyed; we will break any law, and pay any penalty no matter what. When Judge Harold Greene was given that memo, his breakup of that congenitally dishonest and corrupt organization was swift. Still, I had to fight AT&T for six months over false billing (including their ongoing threats) before they finally gave up.

Another example — unless you believe that being kidnapped into the most incompetent (and out-of-insurance network) hospital in my region is even remotely acceptable. When it happened to me, I was locked out of my own house, without keys, phone, billfold, cash, or contact info. Never mind that I was eligible for the same work to be done at my local VA hospital where the bill was paid in total long ago. But the local fire department EMTs didn’t work for the VA — they reported to their medical director who (I learned six months later) was on the payroll of that least competent hospital. What a surprise.

I’ll spare you a lot of detail. But that hospital incompetently failed to provide me with mandatory monthly instructions to change out an implanted gadget which otherwise could risk extreme pain and death. This same hospital then offloaded me into a “rehab” facility which didn’t know the difference between the medically mandated diet I required … and a fried hockey puck. It was so bad that their head chef asked me for an appointment to teach him what to cook and serve.

That “rehab” facility even had me shipped back to the incompetent hospital by ambulance to change out part of a medical gadget that I later learned was both dirt cheap but working perfectly. For that sorry 4-1/2 misadventure I got a $15,800 bill for unnecessary work that only cost in the low hundreds when it was installed originally in new condition. This was also a facility with staff that vandalized my clothes when I was out of the room. Even their medical director was a guy who came into my room, introduced himself, asked me no questions, did no exam of any kind (after which I never saw him again), but he did bill me for several hundred dollars.

If you believe that incompetent medical kidnappers should be compensated under such gross circumstances, then I can’t help you. But if you understand that there is a whole body of knowledge on how to fight such predatory madness, then read on.

There are organizations which can 1) negotiate on your behalf to cut down on such bills, or 2) teach you how to do that yourself. There are also rules that vary from state to state on how long you have to dispute such injustices — which the hospitals will never tell you. So if you find out about those short fuse time limits after being snake-bit by them, then you might have some extreme interest in what constitutes legal defense in your state. Some states have a homestead law which protects your house against any court judgment as long as you continue living there. If you have other property, there is an advantage to holding it in a land trust under a trained trustee’s name so that such property will never show up in an attorney’s pre-case asset search — which they run to see if you have enough goodies worth stealing. Real estate investors have long ago learned to hold their assets in such a land trust to ward off what would otherwise be an endless assault of frivolous lawsuits. That’s the community where that body of knowledge is found.

There could also be an advantage in keeping only the minimum amount in your bank or credit union so you can pay your mandatory monthly bills, and only adding more dollars when you need to make extra purchases. That could help keep a court judgment out of reach.

Other considerations are that different states have different statutes of limitations (the “SOL”) on how long a bill collector can be ugly to you. For example, if your state’s “SOL” is 4 years, and you don’t make the mistake of paying even a dime on such a bill (which resets and restarts that example 4 year limit), after it expires the bill collectors must give up.

It can also help your sanity a lot if you simply refuse to talk with such bill collectors. A blind but courteous outgoing message on your answering machine can be extremely helpful. It won’t get in the way of your friends, but will be most frustrating to the professional bill collectors that bought your bills off the predators for a song, and are now trying to make a profit. Some will try to hit you with an automated phone message seven days a week. I had one give up after a year and a half of such nonsense.

This is a discussion about conducting a defensive war against predators and incompetents — it’s not about conducting your affairs with honest above-board people you can respect and honorably contracted with.

And as always, if there’s a knowledgeable attorney who wishes to refine any of the suggestions I’ve made, such contributions are welcome.

–Lewis

This is only a small thing, but it can save you some money – Buy generic or store brand product. Often it’s just as good if not better than name brand product, and the savings adds up.

Mow your own lawn, do your own nails (if that is something you keep up), color your own hair, make repairs that you are able to (lots of youtube videos to guide you), plan meals with leftovers in mind (how will you use what is not eaten up), repurpose things and stuff and around the house. “A stitch in time, saves nine”, keep up on maintenance and plan for larger expenses you know are coming e.g. sewer bill, HOA’s, auto ins., increases in mortgage payments due to increases in taxes and insurance, job related expenses e.g. CE, E &O insurance, Office fees, subscriptions etc. Get creative.

We have found a new source of joy in living below our means. For most of our lives, we have endured budgets, prioritized wish lists etc. We now find ourselves in a place of abundance and it’s so fun to be able to give to others. It’s always relative so I’ll skip the actual monetary thresholds we live within. Our joy now is that we have the privilege of living generously. At risk of being shortsighted about the potential for unusually wet “rainy days” in the future, we are living out a newly discovered life of abundance that finally is not all about us. We spent years trying to drill into our kids that “it’s not all about you” and yet I fear that we lived in a way that broadcast the mindset that “it was all about our family – at most”. I want to live this way the rest of my life! It feels supernatural! Debt is a drag and this opportunity to be generous is just one of the amazing freedoms on the “other side”. Full disclosure: I lived in Scotland for three formative years and could not help but absorb some of their legendary frugal mindsets.

I have a long running disagreement with Dave Ramsey’s “Start with the highest debt amount” in his Snowball method instead of starting with the highest interest rate debts. The latter will pay off with a lesser total outlay even if it doesn’t produce the same emotional cheer leading that Ramsey advocates. It’s not that hard to run the numbers both ways on a financial calculator to see which method you prefer.

Also since this thread began back in 2020 the Federal Reserve has accelerated is money printing outrageously. I just read this morning that some 40% of all the US dollars in existence have been created (counterfeited) just in the last year. That means the purchasing power of those dollars that you “save” is being stolen faster than ever before in this country’s history.

That means there’s a premium on getting as much of your saved and earned purchasing power out of dollars (and into skills, assets, businesses, precious metals, etc) as much as possible — leaving the minimums needed for paying predictable bills. There is also the latest war the central banking monopolies have declared on crypto currencies — which threaten to provide competition to the central banking intention to use their own digital money forms that they can counterfeit (to steal purchasing power) with mere button pushing. The US SEC has already announced plans to create some stiff regulations on crypto currencies the government doesn’t issue or control, so it’s unclear how reliable non-government-issued cryptos might be as a store of purchasing power that the government can’t steal.

One very recent example of that war was the IMF telling El Salvador that their blessing of Bitcoin as an additionally acceptable currency along with the US dollar is a mortal sin and that bad things will happen if El Salvador doesn’t back off on Bitcoin. Red China is less subtle — they simply outlawed all cryptos from anywhere else in the world to give them time to create, issue and control their own crypto. I’m sure the IMF is envious.

The challenge will be how and where to preserve one’s purchasing power as much as possible in the face of Federal Reserve counterfeiting as a lead-in before issuing an all-digital FedCoin subject to their expected dishonesty.

–Lewis

When my husband and I got married, we each had a mortgage and equity loans, 2 car loans and multiple credit cards. I started with the lowest principle amounts and paid those off first and then used that money to pay off the others. We sold vehicles and paid cash for their replacements. It hurt giving up my cute little sports car, but the insurance was cheaper on my used wagon and I realized that after all,, it was just reliable transportation that I NEEDED. You have to come to grips with the difference between NEEDS and WANTS. Within 2 years, after many other painful choices, the only debt we had was our mortgage.

There are two concerns I have about paying off our property: wealth taxes and title theft. If a wealth tax is ever established, it depends on how it is structured, would it be net of any debt owed? If so,, having some debt against our property might reduce the wealth tax assessment and help us keep our property. And believe it or not, but having a lienholder on your property actually protects you from title theft. Any one trying to use your property to obtain a loan would only be able to do so for the difference between what is already outstanding and the appraisal. There would be a search conducted for recorded documents at the county office. We have an equity line against our house that we have never used. No debt, but that amount is recorded against our property making the equity appear smaller and reducing the likelihood of someone attempting to fraudulently borrow against it. And they would never be able to transfer it out of our name and into theirs without getting a release recorded from the lienholder. A simple title search would prevent someone from claiming we sold the property to them and stop them from obtaining a mortgage. At least I think that’s the way it would work, if any one has contradictory info, please let me know.

was not aware of the property i.formation

Good to know for future reference, especially since identity theft (even from reatives) seem to be normal.

I live on SS. I have no car, live in subsidized housing, no cable, no TV, no insurance, am allergic to tobacco do nto drink alcohol, never eat out, am disabled and rarely leave my apt. When I do take insurance paid van or city bus. However, I must eat organic or non-GMO foods as I am allergic to glyphosate, and try to cheat and my bowels are pouring blood. Trying to cut there would be folly. My two luxuries are no commercial Youtube because I love music, but not with commercials, and my sub to Bigfish for games to relieve stress. I have high blood pressure I am trying to reduce. I am 68, disabled, can not work. I did get into debt to help a friend who lost his job. Mistake, but I am paying down as I can. Any advice other than starving?